Strong growth in Swiss e-commerce

The e-commerce business in Switzerland, strongly driven by the current COVID-19 pandemic, is flourishing[1]. Many of the major e-commerce merchants reported sales increases of over 30% last year. While this sales growth pleases many retailers, margins in e-commerce remain low. In addition to competitive prices, in particular, the costs for the means of payment (e.g. debit or credit cards) are a cost factor in e-commerce that should not be neglected and which hits the margin.

Mobile payment also gaining relevance in the stationary retail sector

The COVID-19 pandemic has also led to several changes in stationary retail. These are evident especially at the checkout. Parallel to the growth in e-commerce, the use of contactless debit and credit cards and mobile payment solutions has greatly increased here[2]. Since the incurred fees for the strongly increasing card and mobile payment (e.g. Twint) are normally covered by the merchants, there is a need for action.

A cost-efficient means of payment for Swiss commerce

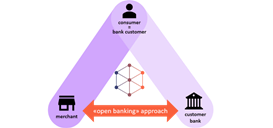

Companies out of OpenBankingProject.ch address this challenge together with banks, merchants, and technology providers as project partners. The shared vision of the initiative is to build a consumer-friendly and cost-efficient means of payment. To achieve this high-cost efficiency, merchants and banks will leverage an open banking approach with account-to-account payments (without intermediaries) using existing infrastructures (e.g. mobile banking app).

The key innovation of OPN-Pay lies in its governance and business model. The governance is an efficient and powerful network of banks and merchants who are equally involved in establishing and further developing the payment method in the market. Thanks to this close cooperation, the means of payment run without intermediaries and thus enable a massive reduction of the fees. The vision of the initiative is to offer the means of payment to small merchants without any fees. However, the payment method is also extremely attractive for larger merchants with an average fee of 0.2% of the transaction amount. In addition, the OPN-Pay business model envisages that the companies participating in the network, depending on their role, will participate in the fee revenues and future profits will be returned to all of them.

OPN-Pay is also attractive for participating banks

In addition to the clear benefits for merchants, the means of payment also offer great opportunities for banks. By integrating the payment method into their mobile banking app, banks will increase the attractiveness and use of this customer interface. In addition, it is also conceivable that with the consent of the consumer, further purchasing information can be transmitted to the bank. This offers the opportunity to the banks in enhancing the personalization of their product and service offerings.

The collaborative initiative has just completed the conception phase and has created the specifications for the connection to the network. The next phase of the project will focus on approaching additional banks and merchants to convey to them the added value of the new payment method and to involve them in the initiative.

For further details or questions, please reach out to Simon Bleher or Thomas Zerndt:

Simon Bleher, project leader, Senior Consultant, Business Engineering Institute St. Gallen AG

simon.bleher@bei-sg.ch

Thomas Zerndt, CEO, Business Engineering Institute St. Gallen AG

thomas.zerndt@bei-sg.ch

Full media release (English)

Full media release (German)

[1] cf. Carpathia – Blogartikel Schweizer Onlinehandel beendet 2020 mit einem Plus von 33% und startet stark ins 2021, https://blog.carpathia.ch/2021/02/25/distanzhandelsmonitor-dezember20-januar21/

[2] cf. Institut für Finanzdienstleistungen Zug IFZ, Mobile Payment Studie Schweiz 2020, S. 30ff - https://blog.hslu.ch/retailbanking/files/2021/02/Studie_MobilePayment_20210103_final_2.pdf