This year, a nucleus of 30 companies from the financial sector and beyond structured and launched the creation of a trust network in the area of "customer onboarding & KYC". The aim is to exchange verified customer information along the life cycle of bank customers in order to make the customer experience more comfortable and the cooperation between companies more efficient. The customers are in the centre and will gain self-determined handling of their data. The next step is to carry out a proof of concept (PoC) with banks, authorities, and technology providers in which a use case based on the architecture concept of Self-Sovereign Identity (SSI) is developed.

Revolution of the onboarding in retail banking

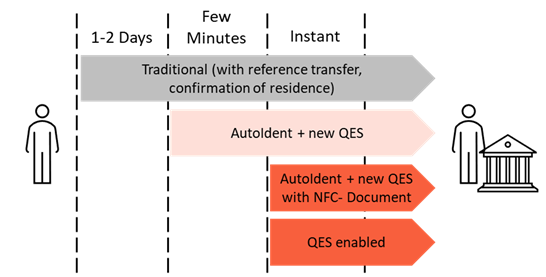

As part of the workshop series "customer onboarding & KYC", OpenBankingProject.ch gained together with its community important insights concerning onboarding in retail banking and developed foundational concepts. The onboarding process of a bank can be made leaner and more efficient by combining unattended video identification with a qualified electronic signature (QES). The acceleration of customer onboarding is illustrated below. The QES can also be used in other business cases within and outside the bank.

The new ETSI standard (TS 119 461), which has been applied in Swiss jurisdiction (ZertES) since the 15th of March 2022, serves as a basis for this revolutionary process improvement as well as for the cross-company use of identification data (link). This European directive sets new standards in identity proofing and simplifies cooperation with trust service providers. All other regulatory bases are given today for exchanging data between banks and third parties. The revised Data Protection Act (nDSG), which is expected to come into force in September 2023, further strengthens the momentum for the acceptance and transfer of identified customer data, as it contains requirements for data portability (link).

Building a trust network creates added value for all stakeholders

The trust network can be divided into four different maturity levels. As a first step, banks can make their customer onboarding much leaner and more efficient based on the above-described findings. The use of unattended video identification and QES eliminates currently necessary process steps such as a bank transfer and confirmation of residence. The time required to onboard a customer is thus reduced to a matter of minutes. In a second level, the customer can share his data, collected during the customer onboarding process, with other banks. The third level involves the exchange of all relevant customer data between banks (e.g. knowledge and experience in the investment business, LSV, e-bill, investment horizon). The fourth level includes the cross-industry exchange of customer data between banks and other companies. This covers, for example, transaction data (e.g. for CO2 footprint), insurance data or land registry data.

The exchange of data between companies and authorities results in a wide range of added value for the institutions involved and their customers. The customer experience becomes simpler, faster, and more secure. Together with the service providers, banks form a trust anchor for their customers. The jointly accepted and deployed standards (e.g., governance, API) increase integration and settlement efficiency between the parties and data quality improves. Ultimately, banks can unlock revenue opportunities in the context of data usage.

Proof of concept based on a representative, cross-industry use case

The community currently sees the greatest potential in cross-industry data exchange between banks and other companies. Therefore, the community agreed in April 2022 to carry out a representative use case as part of a proof of concept (PoC) in order to gain valuable experience in terms of developing a trust network. Furthermore, the PoC takes into account key trends in the context of decentralized business models such as e-ID and SSI.

The selected use case "inheritance of private individuals" offers interesting optimization potential for customers (travel time, efficiency), banks (acquisition of heirs as new customers, efficiency) and other players (e.g. authorities). The architectural concept Self-Sovereign Identity (SSI) is used as a basis, which will most probably also be applied to the Swiss E-ID and the EU-ID. Among other things, this concept offers customers the most possible control over their data and thus increases their sovereignty (more on SSI you find here).

In the coming weeks, a reference solution will be designed to make this complex and time-consuming process as efficient and customer friendly as possible across all entities. This also provides the basis for the project participants' future positioning. Furthermore, the participants have the opportunity to familiarize themselves with SSI and the future Swiss E-ID at an early stage and to shape this topic as an innovation leader in their industry.

The PoC is an important step towards building a trust network in the area of customer onboarding and KYC. The results and findings will advance the vision of enabling data exchange between companies in the context of the entire customer lifecycle and will deliver benefits for all stakeholders involved, especially the customers.

Further information and details about the proof of concept: PDF (in German)